AFFILIATE FOR ROCKY MOUNTAIN COMMERCIAL BROKERS NETWORK

AFFILIATE FOR FLORIDA COMMERCIAL BROKERS NETWORK

Cost Segregation Services Inc. assist all types of depreciable real estate properties. Perkins Financial LLC (Greg Perkins) and Don Little Investments, LLC (Don Little) are both independent consultants with Cost Segregation Services, Inc. (CSSI). While each has their own independent business, we have partnered to support these two affiliated organizations - together we have brought significant income tax benefit – Cash Flow to owners of depreciable commercial and residential buildings.

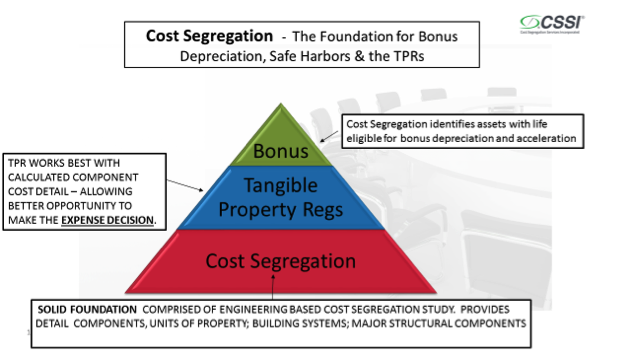

The benefit is derived through accelerated depreciation and the inherent expensing benefits available from the 2014 Tangible Property Regulations (TPR or Repair Regs) - the most sweeping Tax Code change since 1986. The regulation impacted every owner of depreciable property – essentially it dictates whether an owner gets to expense or has to capitalize expenditures. It is totally different from the past. A property owner should have two goals. The first is compliance, the second is to benefit from expensing as much as authorized.

Tangible Property Regulations (TPR or Repair Regs) - the most sweeping Tax Code change since 1986. The regulation impacted every owner of depreciable property – essentially it dictates whether an owner gets to expense or has to capitalize expenditures. It is totally different from the past. A property owner should have two goals. The first is compliance, the second is to benefit from expensing as much as authorized.

Now with the new 2018 Tax Cuts and Jobs Act, there are further enhanced benefits and cost segregation companies are going to be even more in demand to provide source documents that help deliver these benefits. With these Tax Reform provisions, never have more accelerated deductions been available due to 100% Bonus Depreciation, expanded Section 179, Qualified Improvement Property, and the benefits available from the Tangible Property Regulations.

Our cost segregation services became even more valuable as we identify and quantify components eligible for all these. Our core specialty service – Cost Segregation –is the identification and quantification of the asset components eligible for acceleration and expensing benefits.

Our cost segregation services became even more valuable as we identify and quantify components eligible for all these. Our core specialty service – Cost Segregation –is the identification and quantification of the asset components eligible for acceleration and expensing benefits.

Because of the complexities, nuances, and a lack of definitive guidelines, CSSI recognized that many building owners were not going to become compliant and take advantage of the tax savings without assistance from calculation specialists that can quantify the various components of a commercial building. Greg and Don have personally assisted more than 900 properties in 33 states.

If you own your building, you can send your Tax Asset Detail depreciation schedule and receive a free quantitative review. If you are anticipating renovations or building a new facility, you can call either Don or Greg to discuss options to proactively plan to your firm's tax advantage.

Now is the ideal time to think about taxes and CSSI in collaboration with your own tax professional can help your firm navigate the tax law and find the greatest benefit for you.

For more details, contact either Greg Perkins at 256-683-3397 or Don Little at 972-333-5059. Click this link to request a free analysis or call/email Don or Greg directly.

For further information: